|

Projects > Nigeria_Apr-Jul15

|

|

|

|

|

|

|

|

|

The work at Grooming Centre took off with a

presentation of the concepts behind the Risk

and Liquidity Management Tool (RLMT)

to senior management, so that the suggested trainings about these topics

and the implementation of the tool’s inherent asset liability management

(ALM) process could be tailored to the concrete needs of GC. Thereupon the

managers gave comprehensive feedback:

|

|

|

|

|

|

|

“We are currently making these kinds of projections on a branch and

divisional level but this is a tool that allows doing it in a more logical

manner:

· It projects

into the future in a more scientific and sophisticated manner.

·

It will give us more strength on a divisional

level in planning and will help us develop and analyse scenarios.

·

The tool structures the work we do in a more systematic

manner and helps us work on the growth rates we are going to apply as per

the business plan. It therefore helps us see the gaps in terms of liquidity

planning so that we can determine our concrete plans, which increases our

overall credibility.

·

While this does not change how we approach the

planning process per se, we now have a tool that allows us to test any

strategy using the parameter fields provided in the blue cells. The values

to be set here will make transparent what we are planning to do in the

future

·

The tool will simplify the current manual process

of projecting disbursements and savings going on at the branches, and will

strengthen the aggregation process on the division level.

· The tool

helps analysing the factors that should bring branch, area or

division toward self-sustainability. We can compare what one area manager

is doing to another one. We look forward to moving forward with this tool.”

|

|

|

It was decided that the branch and head office

level courses associated with the RLMT’s two components, the liquidity forecast ladder branch and

the liquidity forecast ladder HO & consolidated, respectively, were to be held for senior

trainers from head office, staff and managers from the finance department,

the executive assistant, the risk manager as well as the managers of the

four program areas (HO course), and some of the 24 divisions (branch

course):

|

|

|

|

|

|

|

|

|

|

|

Together with Dr. Birgit the class projected likely changes in outstanding deposits and other quantities determining the future level of liquidity for various scenarios. This lead to lively discussions between the participants who assisted each other in filling in the parameters of the tool.

|

Since the branch level course

happened to be on a Friday which is GC’s “cultural day”, participants

dressed in their traditional costumes. During lunch hour the branch level

course was visited by the directors.

|

|

|

|

|

|

|

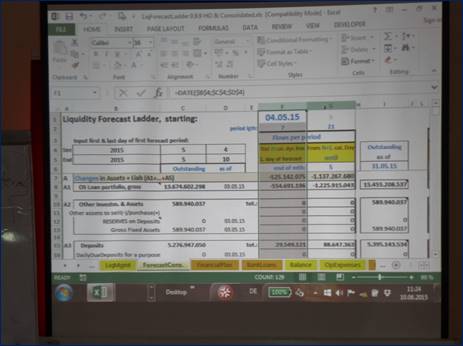

Using the head office & consolidated liquidity ladder component

participants in the HO course consolidated HO and branch data in order to

measure incoming and outgoing cash flows and short-term liquidity needs.

They also forecasted medium-term liquidity needs based on the five-year

business plan, liquidating or increasing foreign debt and (term) deposits.

|

Participants stated that in particular the

detailed business plan resulting out of the projection model will be very

useful to them. It also triggered fruitful discussions between the staff on

the asset side of the institution and their colleagues on the liability

side, which are crucial for a well-functioning ALCO.

|

|

|

|

|

|

|

|

|

In order to tailor the model to the needs of the institute a typical

client group had been visited

|

|

|

The RLMT is a powerful

tool, which, besides its ability to forecast liquidity, allows for a

systematic analysis of the current loan and deposits portfolio for each

branch (in the case of GC, the branch level is brought up to division

level) as well as its changes and trends over time.

This functionality

is based on tailor‐made reports of client transaction data per branch

set up in the core banking system (CBS). With the click of a button, these

reports can be downloaded and imported into the MS Excel based branch

component of the liquidity forecast ladder. With its functionalities, the

RLMT fully covers ALM, cost management and analysis of the balance sheet,

as well as advanced RM, such as expected default frequencies and at the HO

level value at risk (VAR).

As the RLMT could not be fully put into service before the full implementation of the CBS, Dr. Birgit had developed a temporary solution. The temporary solution works with input files from the manual MIS system that GC employed at that time and used division level data as a proxy for branches.

|

|

|

|

|

|

|