|

|

|

2017 - Celebrating 10 Years |

|||

|

IFD International

Finance Development |

of innovative project

work |

||||

|

|

|

|

|||

|

Some key activities: Loan pricing and quantitative management tool: SIAP-Simulasi

BPR for Indonesia’s People’s Credit Banks

Risk and

Liquidity Management tool: RLMT with an embedded largely automated ALM process from

branch to Head Office & Consolidated level autonomous model, applicable to any community |

|

The vision of International Finance Development is to make a profound

contribution to the enhancements of financial systems in developing and

transition countries that will enable the respective economically active poor

to realize their full potential. |

|

||

|

The approach taken:

Development of concepts and applications which are tailor made for the

respective local situation by combining mathematical

skills with many years of experience in international finance, in particular in market

- and credit risk management as well as long term project and personal related experience in various, developing countries. A high value is set on

working together with people

Since the establishment

of IFD in July 2007 until 2011 a major focus was given to continued work in

Indonesia supporting the People’s Credit Banks (BPR) with a loan pricing and

quantitative management tool to analyse the current and simulate the future

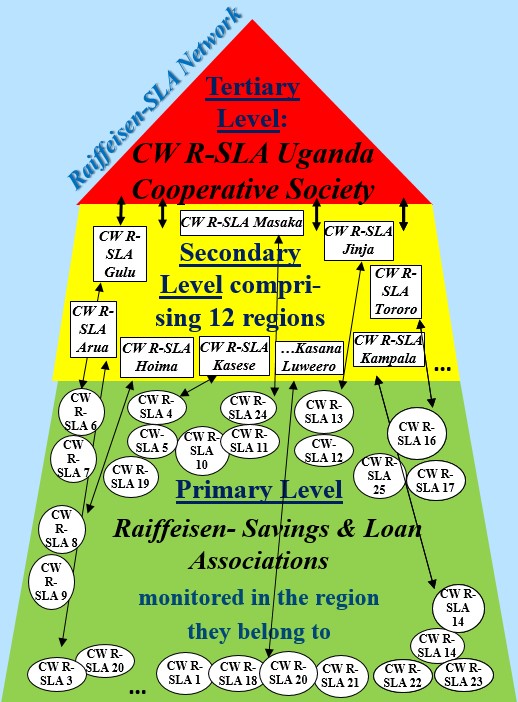

business. For MFIs in any country a tool for risk management & dynamically forecasting liquidity, based on the expected cash flows at branch as well as head office & consolidated level was designed. The tool is used for training as well as implementing the underlying asset liability management process at MFIs especially those who are allowed to lend clients’ deposits. Working with the Ugandan

Cooperative Alliance, the demand for innovative course modules and hands-on tools for their member cooperatives was recognized and met resulting in a Savings- & Loan Portfolio Management

Tool (SLPMT) for MFIs without a core banking system and a Produce- & Pay Planning and Management

Tool (PPPMT) for agricultural cooperatives and their unions. The model of a three-level Raiffeisen Network of Savings- & Loan associations (R-SLAs) applicable within any community was developed and established together with the Catholic Workers Movement Uganda. This unique model is based on three pillars: A rigorous three-level internal audit, self-monitoring & evaluation system; a practical tool for micro business financial-planning; and Linkage-Banking. The corona pandemic triggered the idea to digitise this autonomous self-monitoring system also on primary level through group ledgers, running on members' own smartphones. The "Digital-Ledgers" offer fully automated audit functionalities and monthly financial statements. The model is suitable for improving the economic efficiency and sustainability of many community development projects. Dr. Birgit Galemann |

|||||